WEALTH FOR PEOPLE.

GROWTH FOR INVESTMENT FIRMS.

CAPITAL FOR PLANET.

Financial stress is not caused by lack of income, but by unpredictable money flow.

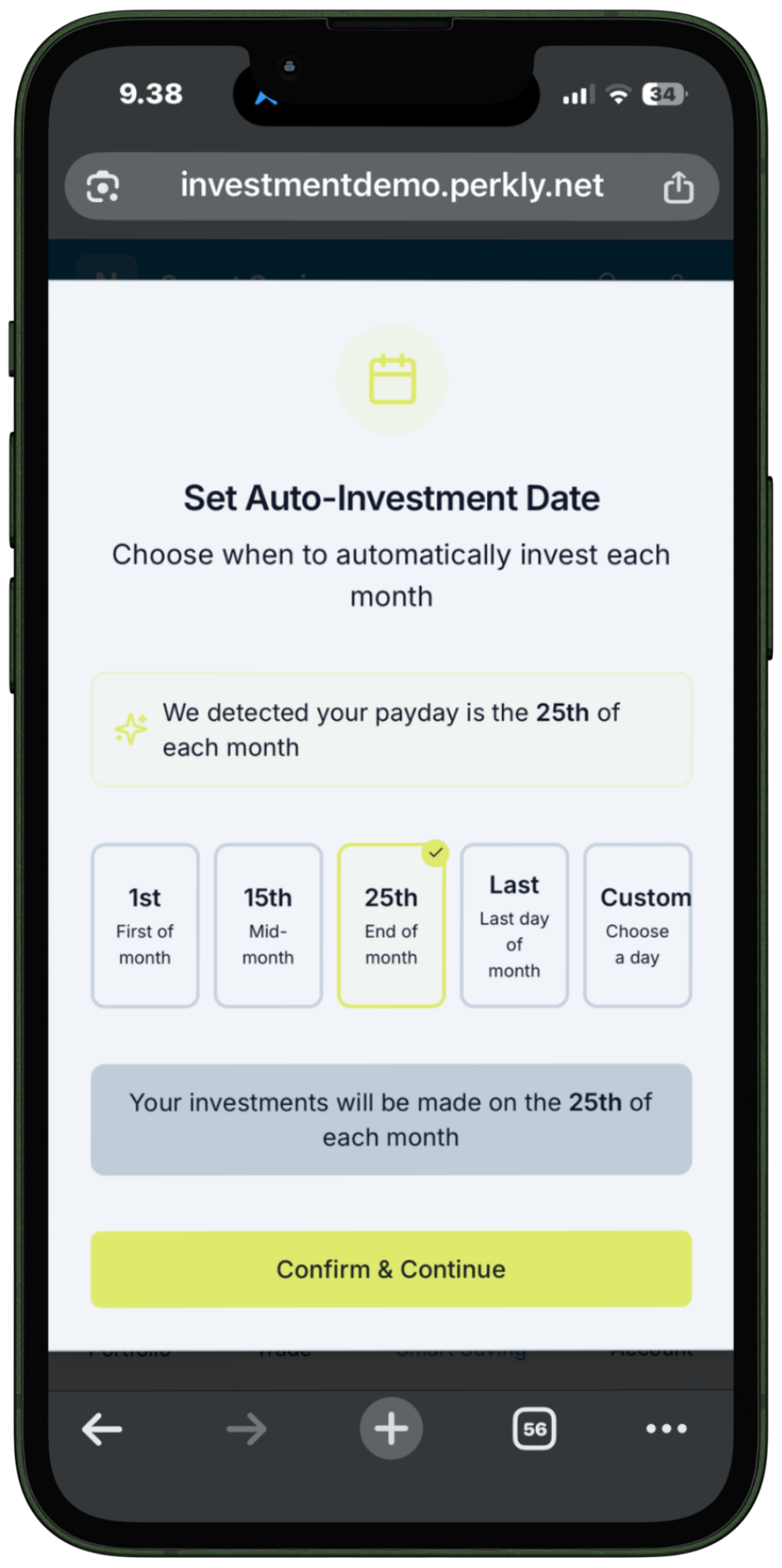

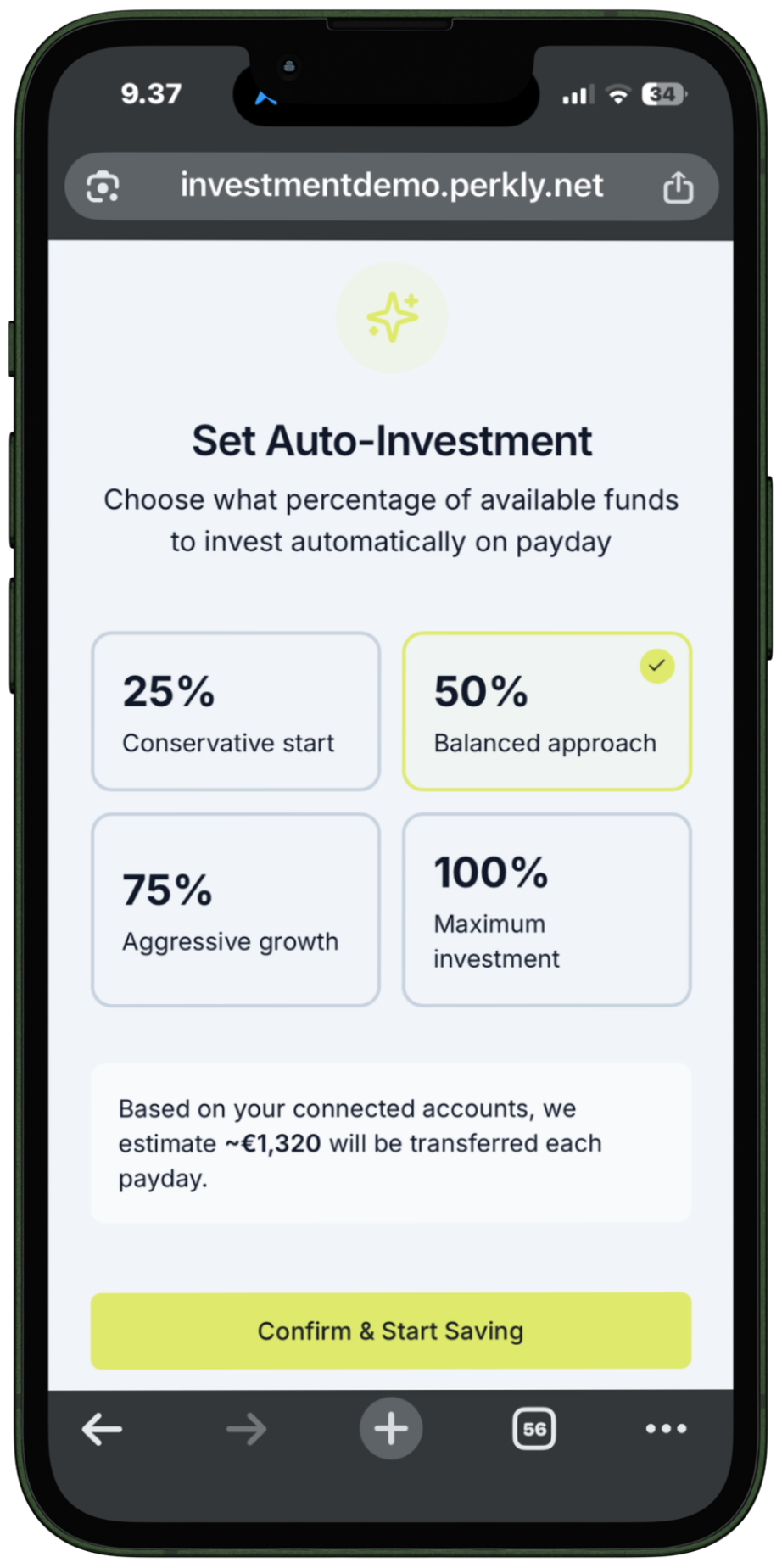

Perkly reduces this stress by turning everyday spending behavior and idle balances into predictable, habit-based investment flows. In doing so, we help people build wealth, enable sustainable growth for banks and investment firms, and channel capital toward a more resilient and sustainable future.

WHY IT MATTERS FOR INVESTMENT BANKS, ROBO-ADVISORS AND DIGITAL WEALTH PLATFORMS?

When customers feel financially and emotionally well, they stay loyal, trust their investment bank more, and engage with new services.

Reducing financial stress and eco-anxiety isn’t just a social goal, it’s a growth driver. Investment banks that help their customers make smarter, more sustainable choices see higher satisfaction, more revenue, lower churn, and stronger ESG performance.

With Perkly, investment banks can turn everyday payment data and idle money into revenue and customer wellbeing — creating deeper relationships and real impact, one purchase at a time.

Meet the Team

Aligned with UN SDG 12

Perkly champions responsible consumption, supporting the UN’s Sustainable Development Goal 12: fostering sustainable consumption and production worldwide.

JOIN THE MISSION.

We are looking for investors, partners and users to change our buying behaviour to more responsible. Send us a message how do you want to make this happen.