PERKLY UNCOVERS HIDDEN SAVINGS FROM CONSUMERS DAILY SPENDING AND IDLE DEPOSITS.

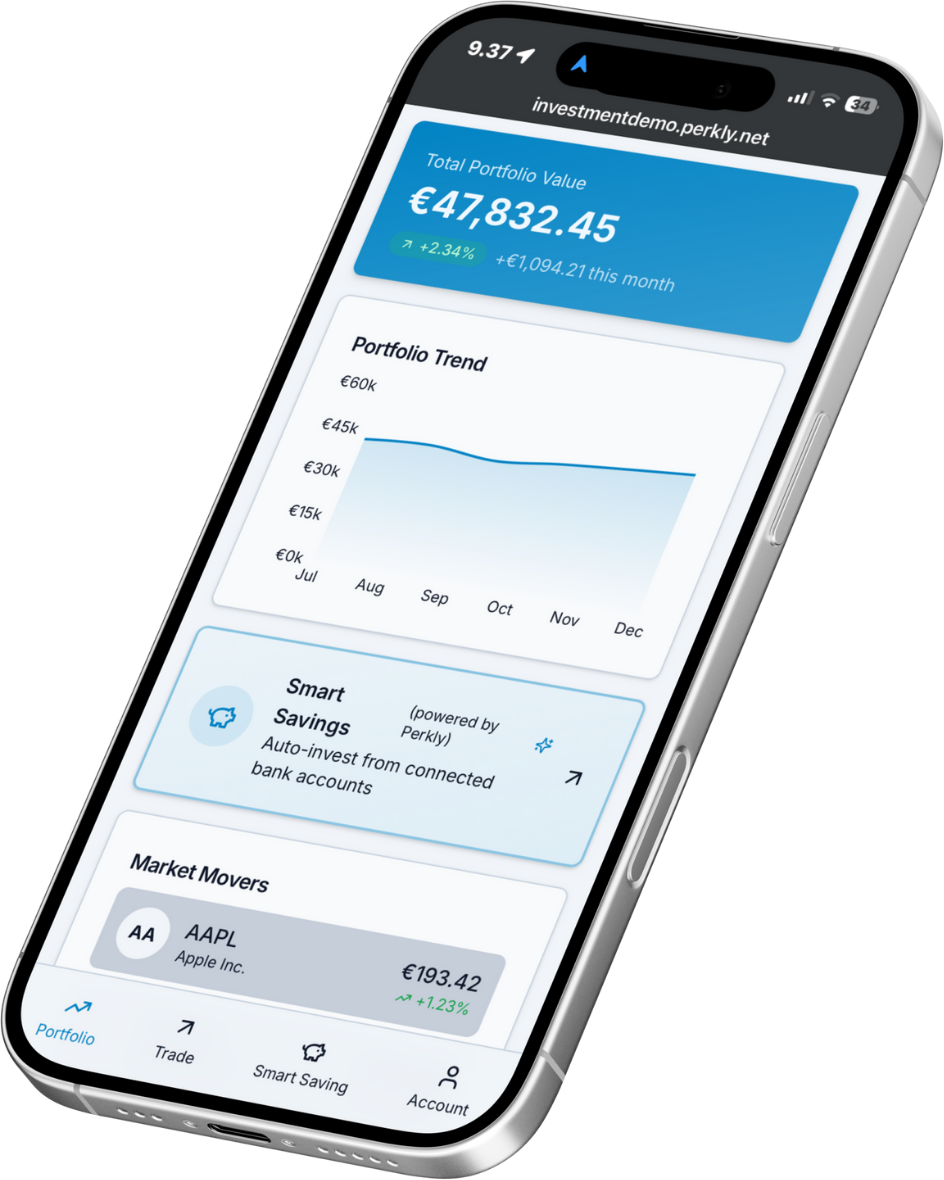

AND AUTOMATICALLY REDIRECT THEM INTO INVESTMENT FIRMS’ SAVINGS , ROBO-ADVISORS AND INVESTMENT PRODUCTS.

BEHAVIOURAL AUM INFLOW ENGINGE FOR RETAIL INVESTMENT FIRMS.

INVESTING IS AUTOMATED. MONEY FLOW ISN’T.

Portfolios rebalance automatically, risk is optimized, and investing products are fully digital. Yet the most critical step - moving money into investments - is still manual, emotional and irregular. Existing activation tools and means are expensive, ineffective and non-scalable

Perkly automates money inflow by turning everyday spending behavioiur into recurring, habit-based investment flows.

PERKLY’S BEHAVIOURAL AI ENGINE MAKES MONEY GROW FOR PEOPLE AND INVESTMENT FIRMS.

-

1. FIND & ANALYZE

AI detects hidden saving potential in transactions and deposits.

-

2. COACH, NUDGE & GAMIFY

Personalized nudges and gamification drive smarter financial habits.

-

3. AUTOMATE & REDIRECT

Freed funds flow automatically into your existing savings and investment products.

BASED ON GAMIFICATION AND AI INSIGHTS

Gamification transformed how people learn.

Now, it transforms how your customers save and invest.

Perkly uses behavioural science, nudges, and game mechanics to increase engagement and drive real financial outcomes. Progress streaks, milestones, and dynamic goals help customers reduce impulse spending and redirect freed money into savings and investment products - automatically.

The result: higher activation, stronger loyalty, and measurable AUM growth.

WITH PERKLY, CONSUMERS BUILD WEALTH. INVESTMENT FIRMS GROW AUM - ORGANICALLY.

REAL RESULTS - AUTOMATICALLY

AVERAGE CUSTOMERS’ SAVINGS INCREASE 50-150€ / MONTH

INCERASE CUSTOMER ENGAGMENT. 3x ONLINE BANK USAGE

AUM GROWTH POTENTIAL 50-150M EACH YEAR/ 100k CUSTOMERS

BEHAVIOURAL CUSTOMER DATA FOR ESG REPORTING

REDUCE SALES AND MARKETING COSTS -50%

TURN DEPOSIT ACCOUNTS INTO YOUR GROWTH ENGINE.

WITH PERKLY’S OPEN-BANKING API INTEGRATION, YOUR CUSTOMERS CAN CONNECT ALL BANK ACCOUNTS GIVING YOU FULL VISIBILITY INTO THEIR FINANCIAL BEHAVIOIUR.

PERKLY IDENTIFIES IDLE SAVINGS AND RECURRING WASTEFUL SPENDING FROM ALL CONNECTED ACCOUNTS, THEN NUDGES AND GAMIFY CUSTOMERS TO MOVE THAT MONEY INTO YOUR SAVINGS ACCOUNTS AND INVESTMENT PRODUCTS.

SOUNDS AMAZING?

WHY BANKS AND INVESTMENTS FIRMS CHOOSE PERKLY?

-

AUTOMATIC AUM AND REVENUE INCREASE

PERKLY AI TURNS BANKS’ LIABILITIES INTO ASSETS UNDER MANAGEMENT

-

AUTOMATED ESG AND WEALTH METRICS

DATA READY FOR CSDR AND TRANSITION PLANS.

-

PROVEN IMPACT

REAL IMPROVEMENTS IN INVESTMENT PRODUCT SALES, ENGAMENT AND LOYALTY.

-

REDUCE SALES AND MARKETING COSTS

AI and automation enables +20% reduction for sales and marketing costs.

MAKE MONEY MOVE SMARTER.

PERKLY WAS FOUNDED TO HELP BANKS, ROBO-ADVISORS AND FINANCIAL FIRMS EMPOWER CUSTOMERS TO BUILD LASTING FINANCIAL WELLBEING.

WE COMBINE BEHAVIOURAL SCIENCE, AI AND BANKING EXPERTIZE TO CREATE ACTIVATION LAYER MISSING IN TODAYS FINANCIAL SYSTEM.

CONTAC US TODAY!